what is fit on a pay stub

Some are income tax withholding. FedFWTFITFITW Federal tax withholding.

Online Pay Stub Generator Create Employee Pay Stub Year Of Dates Company Names Paycheck

Fit stands for federal income tax withheld.

. A trademark is a word phrase or design that identifies the source of goods and services in such a way as to distinguish them from other products or services. A company specific employee identification number. FICA stands for Federal Insurance Contributions Act.

The rate is not the same for every taxpayer. Common Abbreviations Used on Paycheck Stubs. The federal government receiving the FIT taxes will typically use the funds to finance various federal programs and fund various sectors like education transportation energy and other areas.

How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn. Reddits home for tax geeks and taxpayers. General Pay Stub Abbreviations.

Reg Pay - Regular pay - hourly. Federal Tax or Federal Tax Withheld. Finally commercial insurance can help reduce your tax burden.

In the United States federal income tax is determined by the Internal Revenue Service. This makes sense thank you. Fit stands for Federal Income Tax Withheld.

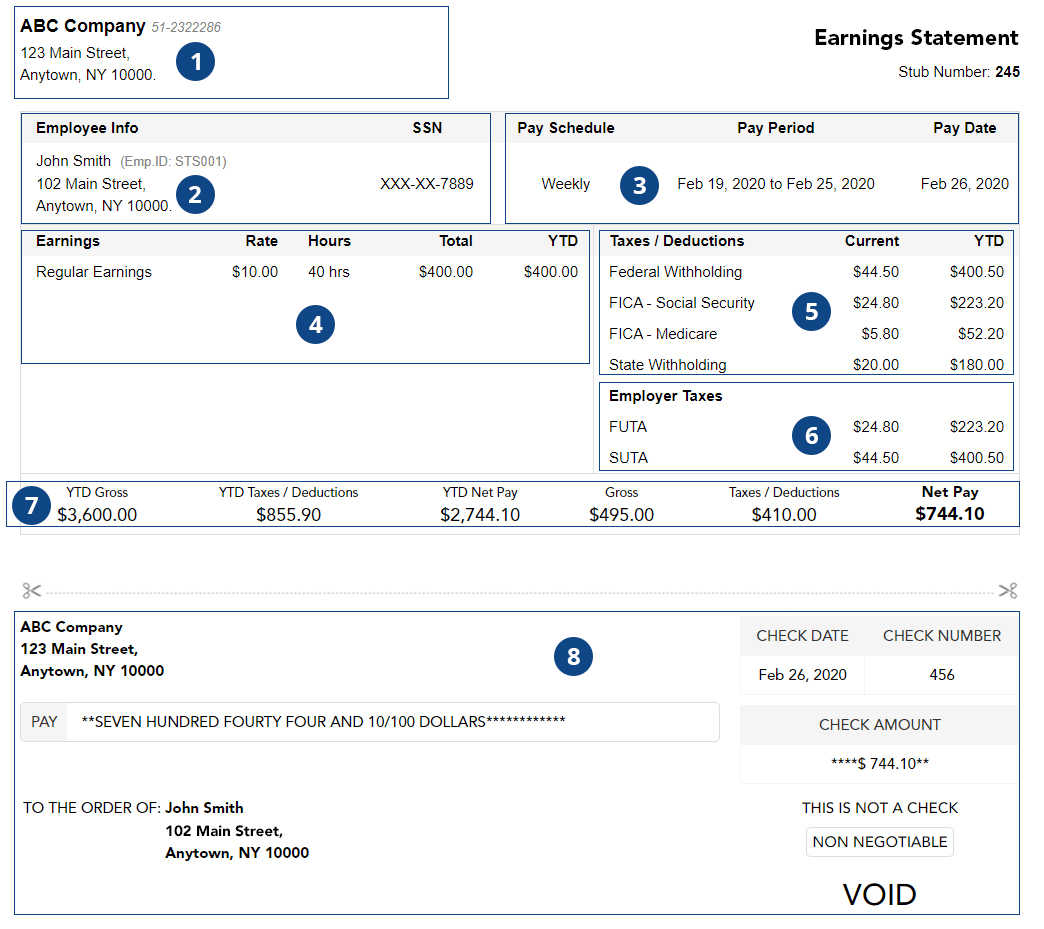

They are all different taxes withheld. A paycheck stub summarizes how your total earnings were distributed. FIT is withheld from an employees paycheck based on the amount of their federal taxable wages.

Jury - Jury duty pay. Here are some of the general pay stub abbreviations that you will run into on any pay stub. FIT stands for federal income tax.

Local Tax Localcity tax withholdings. The check stub also shows taxes and other deductions taken out of an employees earnings. These are matched by your employer.

Social Security and Medicare. Your net income gets calculated by removing all the deductions. Pay stubs provide a helpful breakdown of gross pay net pay and all the deductions in between.

FIT stands for Federal Income Tax. The taxable wages for federal tax for withholding purposes is gotten by taking the gross pay and removing any exclusion that may exist for that employee. Paycheck stubs are normally divided into 4 sections.

It gets removed from your pay added to the Social Security Tax on Medicare Tax Social Security Tax on Wages. In addition commercial insurance helps protect your business assets. The information on a paystub includes how much was paid on your behalf in taxes how much was deducted for benefits and the total amount that was paid to you after taxes and deductions were taken.

Misc - Miscellaneous pay pay they dont have a code for Move Rem - Move reimbursement. FIT is applied to taxpayers for all of their taxable income during the year. If someone else uses your mark without permission.

The FIT gross is what I would expect to see in Box 1 of the W-2. OASDI FICA SS or SOCSEC. The rate is not the same for every taxpayer.

The taxable wages are likely less than his actual salary because of pre-tax deductions health insurance retirement investments etc which reduce his taxable income. If you are wondering what is FIT on my paycheck it is essentially an amount of money that is withheld from your pay or salary to pay towards your federal income tax. EE stands for employee.

State Tax or State Tax Withheld. In most cases you will see money held back from your paycheck for two government-funded programs. Fit is applied to taxpayers for all of their taxable income during the year.

FIT on a pay stub stands for federal income tax. Your pay stub will also show how much youve earned during the year so far and for that pay period. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes.

For a long time the government has run on a deficit meaning the current expenses exceed current revenues. This is the amount of money earned during the pay period. STATE SIT or SITW.

While the task of figuring out FIT withholdings for your employees may seem tricky with the help of Block Advisors payroll service or payroll software like Wave your payroll to-dos just got easier. FICA taxes are payroll taxes and they are a flat 62 social security tax and 145 medicare tax. It can be used on packaging labels signs or any other means of advertising.

The owner of a trademark has exclusive rights over its use. PTO - Personal time off or paid time off. FIT stands for federal income tax.

There are four types of taxes taken out of your paycheck every week. To keep errors to a minimum check your. St TaxSWTSITSITW State tax withholding.

What does FIT EE on a payroll check mean. This is the amount of money an employer needs to withhold from an employees income in order to pay taxes. Aside from tax deductions however there are some before-tax deductions that may appear on your paycheck stub as well.

Some entities such as corporations and trusts are able to modify their rate through deductions and credits. FIT Fed Income Tax SIT State Income Tax. So I assume on a payroll check.

Below are the most common paycheck stub abbreviations that deal with before-tax deductions. Personal and Check Information. The name of the Employee.

FED FIT or FITW. FIT is applied to taxpayers for all of their taxable income during the year. The Employees social security number.

OT15 - Overtime pay at 15 times your regular pay rate OnCall - On-call pay. Net - Earnings after taxes and deductions. It itemizes the wages earned for the pay period and year-to-date payroll information.

For instance if you rent office space commercial insurance can cover any damage caused by a fire. A pay stub also known as a check stub is the part of a paycheck or a separate document that lists details about the employees pay. Here are some of the most common pay stub deduction codes demystified.

Both FICA and FIT are large components of the Federal governments revenues used to pay current expenses. FIT deductions are typically one of the largest deductions on an earnings statement. FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return.

On a pay stub this tax is abbreviated SIT which stands for state income tax. These items go on your income tax return as payments against your income tax liability. Liability insurance protects your business against lawsuits filed by customers or employees.

Social Security or Social Security Tax Withheld.

Canadian Check Pay Stub Template Google Docs Google Sheets Excel Word Apple Numbers Apple Pages Template Net Templates Canadian Excel

What Does A Salary Pay Stub Look Like Quora

Fillable Form Pay Stub Budget Forms Paying Paycheck

Pin On Beautiful Professional Template

A Guide On How To Read Your Pay Stub Accupay Systems

What Does A Salary Pay Stub Look Like Quora

What Everything On Your Pay Stub Means Money

Payroll And Statutory Obligations Being Facilitated Barbados Today Payroll Software Payroll Bookkeeping Services

Decoding Your Pay Stub Infographic Money Management Decoding Understanding Yourself

Independent Contractor Pay Stub Template Elegant 10 Fillable Pay Stub Template Payroll Template Template Free Powerpoint Timeline Template Free

Different Types Of Payroll Deductions Gusto

Sample Pay Stub Opportunities For Wbc

Online Custom Pay Stubs Online Custom Pay Stub Generator Payroll Template Custom Paying

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Template 3 Stub Payroll Template Templates Car Loans

Be Different Choose A Solution Just For You Payroll Hiring Employees Stagecoach